Closing Deals In The Middle

Of A Global Pandemic

At NuVescor, we align the interests of investors and business owners to enable the personal and financial goals of our clients. For over a decade, we have helped founders and owners of companies in the manufacturing sectors achieve maximum value for their companies. Together, we can provide business valuations, financial analysis, investment guidance, and business transaction advice for middle-market companies with revenues from $5 million to $500 million.

In this post, we’d like to share with you 4 case studies that illustrate the impact that COVID-19 had on certain businesses and provide an update on trends we are currently seeing.

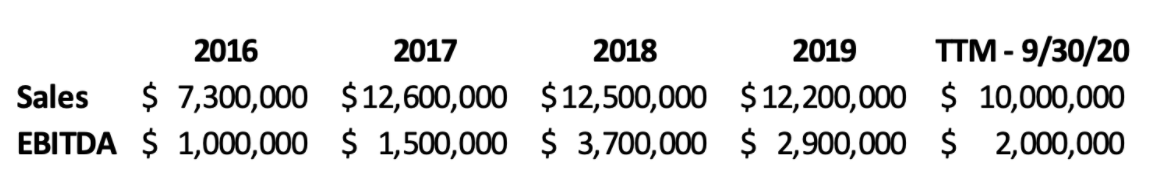

Case Study #1 – Significant COVID Impact

- Automation business: 80% concentration to one customer, 90% of sales are in automotive industry

- Sales rebounded nicely, but backlog suffered

- Backlog at launch: $12,000,000+

- Backlog at close: $4,600,000

- Changes in business = changes in deal

- Value held up

- $1.85M in seller financing switched to an earnout

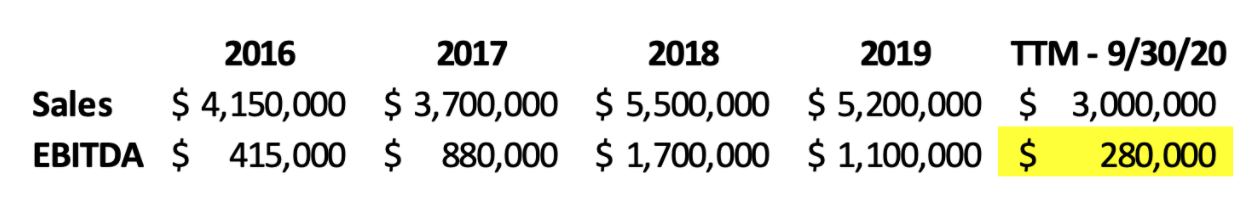

Case Study #2 – Significant COVID Impact

- Coating and equipment business, serving automotive and aerospace customers

- Sales negatively impacted, with no rebound yet

- Changes in business = changes in deal

- Bank decides they are going to lend $1,300,000 less than their commitment letter

- Total value reduced $500,000

- Seller financing increased $800,000

- Buyer tapped out on down-payment

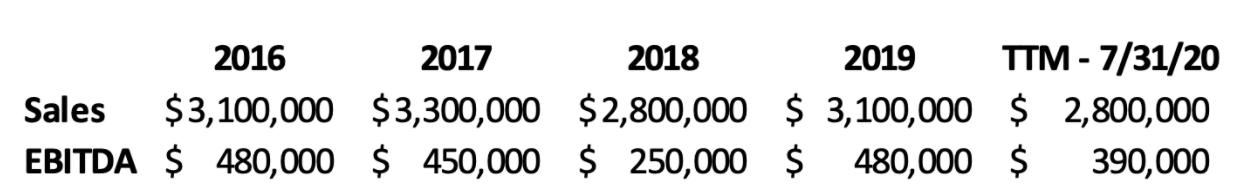

Case Study #3 – NO Significant COVID Impact

- Styrofoam pattern company serving industrial casting and tooling customers

- No real sales dip due to COVID (aside from February)

- No change to valuation or deal structure from LOI

Case Study #4 – NO Significant COVID Impact

- Snack food manufacturer that manufactures for other brands

- Sales actually increased throughout COVID (people gotta eat, right?)

- No significant change to valuation or deal structure from LOI, even under the scrutiny of private equity quality of earnings pressure

What We’re Seeing in the Market

- Sellers are still selling, buyers are still buying, banks are still lending

- 1 closing in February, 1 in May, 2 in June, 1 in August, 1 in September, 1 in October

- There are still real outliers to the high side, but fit/motivation must be perfect

- Recently signed LOI for Manufacturing Business with less than $10 Million in sales – 4 LOIs submitted @ 5x multiple and signed LOI at 7.5x multiple all-cash stock sale

- That pesky PPP loan uncertainty: be ready to escrow funds as part of the closing proceeds

- But remember – the seller stays in control!

- Watch out for scams/wire fraud!

- Lost one, caught one