MIDWEST MANUFACTURING SOFTWARE DEVELOPER

Midwest Manufacturing Software Developer

NVC2253

About the Company

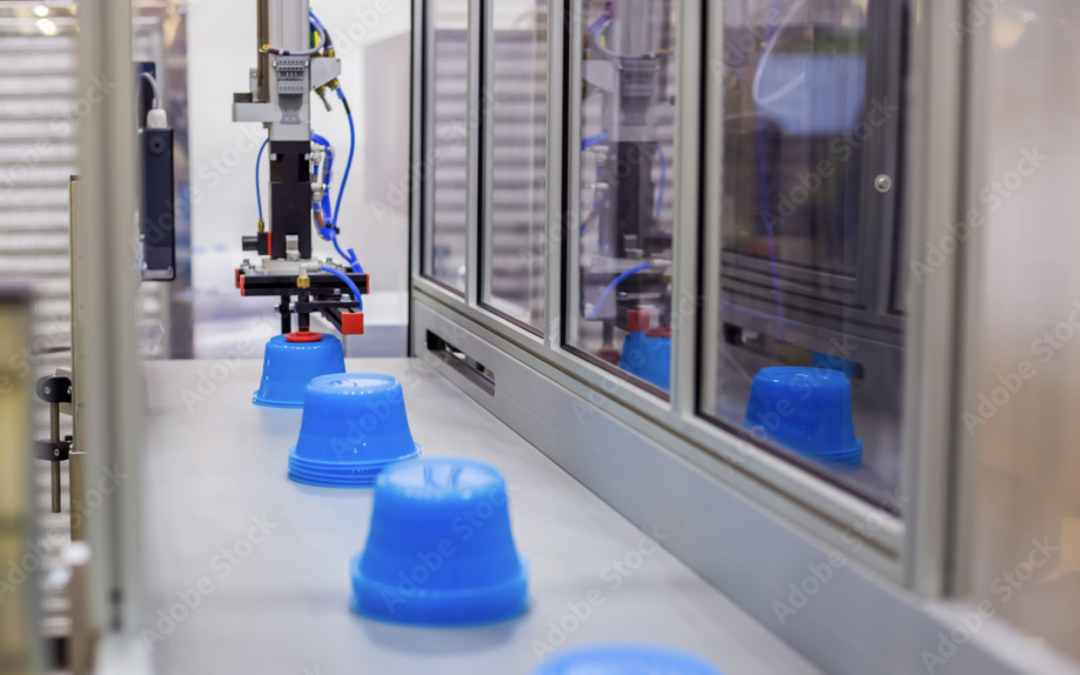

This fast-growing Midwest software developer provides manufacturers with customizable systems that gather automated production data, integrate it with other business systems, and make it accessible and meaningful at the plant floor, management level, database and beyond. Its connectivity software simplifies and streamlines manufacturers’ production monitoring, recipe management, quality/statistical process control and work instructions. The software allows clients to maximize efficiency and profitability and more accurately determine return on investment. The Company has developed loyal customers across a broad geographical area in the U.S. and internationally and presents a strong growth opportunity for a new owner.

GROWTH OPPORTUNITIES

Rising sales – Sales have grown substantially over the past three years, with another good year forecasted for 2024.

Enhanced marketing – Current sales are primarily through word of mouth and marketing is practically nonexistent. The Company’s website is also overdue for a refresh. An increased focus on sales and marketing could boost revenues.

Product development – The Company continues to improve and add features to its software products, oftentimes at the request of customers.

Customization – The Company understands customers’ unique needs and customizes software to fit them.

Talented staff – Employees have the programming skills and product knowledge to please even the most demanding customers.

Widespread sales – Sales are spread geographically, with about 40% in Michigan, 40% elsewhere in the U.S. and 20% international.

REVENUE AND EBITDA

| 2021 | 2022 | 2023 | 2024 Pipeline | |

| Revenue | $440,000 | $1,000,000 | $1,800,000 | $2,500,000 |

| EBITDA | -$80,000 | $200,000 | $700,000 |

If this opportunity fits your Company, please fill out the below NDA to get started and contacted with more information.

Contact us for more information!

NuVescor Group (616) 288-4047 Ext: 100

Recent Comments