IEQ Industries acquired by Gallagher Fluid Seals, Inc.

Gallagher Fluid Seals, Inc.

GRAND RAPIDS, Mich. – April 25, 2022– NuVescor Group is pleased to announce the successful sale of IEQ Industries to Gallagher Fluid Seals, Inc.

IEQ Industries is a distributor of new, used and remanufactured pumps, pump parts and pump packages for various commercial and industrial applications, including oil and gas production, around the world. Though the owner is in Grand Rapids, all staff work remotely from home offices, so there are no Company facilities.

Gallagher Fluid Seals is a global distributor and manufacturer of fluid sealing products that has grown substantially over the past seven years both organically and through acquisition. The Company has its headquarters in King of Prussia, Pa., and a gasket fabrication and sales office in East Longmeadow, Ma.

Chief Executive Officer Chris Gallagher said IEQ Industries is a growing company in strategic end markets for Gallagher Fluid Seals, and the purchase provides for significant diversification of the company’s product mix. He also cited IEQ Industries’ focus on high pressure pumps and components, its ownership of multiple Internet domain names and its CXI platform, an enterprise asset management system it developed for pump end users.

Gallagher said he plans to continue IEQ Industries’ growth. “The slate of digital assets that came along with IEQ are an opportunity I will be spending a lot of time with the team over the coming weeks and months developing strategies to further expand,” he said.

“While our expressed goal is to diversify our product mix, having crossover in market segments allows both IEQ and Gallagher Fluid Seals to benefit from historical customer relationships. From an operating perspective, it is fantastic that the entire IEQ team will be able to stay in place and help us continue to invest and grow this business.”

IEQ Industries Owner Joseph Bichler said he’s been working for the last six years to position the Company to run without him so he could retire and ensure the business’s continued success.

“We worked to put systematic and documented business practices in place while continuing to focus on growth,” he said. “My team took leadership and officer roles. The timing was right for me personally, too. I was ready to retire and enjoy more time with my family and pursue new interests.”

Under the new owners, “the sky is the limit” for IEQ Industries, he said.

“It was clear that this was a strategic buyer who saw the synergies and pathways for creative growth,” Bichler said. “Chris Gallagher and the IEQ team are already strategizing. It will be exciting to see.”

IEQ Industries was assisted in the transaction by Nuvescor Group, a West Michigan mergers and acquisitions service company.

“It is always exciting when a fit is confirmed between the buyer and seller, and this was the case with IEQ and Gallagher Fluid Seals,” said Travis Ernst, Nuvescor’s Operations Manager. “Part of our process is understanding the ideal buyer for our client, and in this case, we were able to find the right buyer who can take what Mr. Bichler has built in IEQ and bring it to the next level.”

About IEQ Industries

IEQ Industries, established in 1988, produces no pumps or parts itself but maintains well-established relationships with suppliers to purchase OEM and aftermarket pumps, complete customer specific turn-key pump packages and parts for resale to customers on all seven continents. In addition to the energy industry, its products are used in applications including water treatment, reverse osmosis/desalinization, agriculture, waste management and car washes.

About Gallagher Fluid Seals, Inc.

Founded in 1956, Gallagher Fluid Seals represents the strongest seal manufacturers in the world, in addition to operating its own gasket fabrication facility. It serves both original equipment manufacturers and maintenance, repair and operations customers through the development of technical solutions that solve sealing challenges.

About NuVescor Group

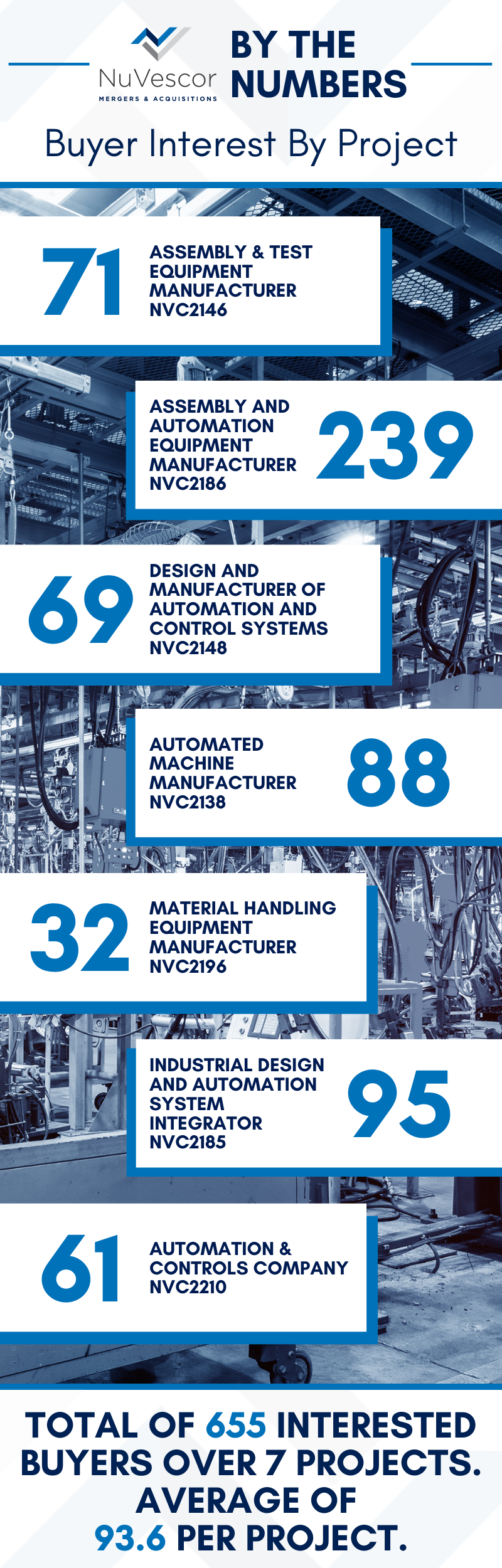

NuVescor Group, based in West Michigan, is a distinguished mergers and acquisitions service company that partners with other professional service providers to present the full array of disciplines needed to have successful and timely business transactions. NuVescor utilizes a proprietary proven process that greatly increases the success rates for business transactions as well as the customer experience. For more information, please visit nuvescor.com.

###

Recent Comments