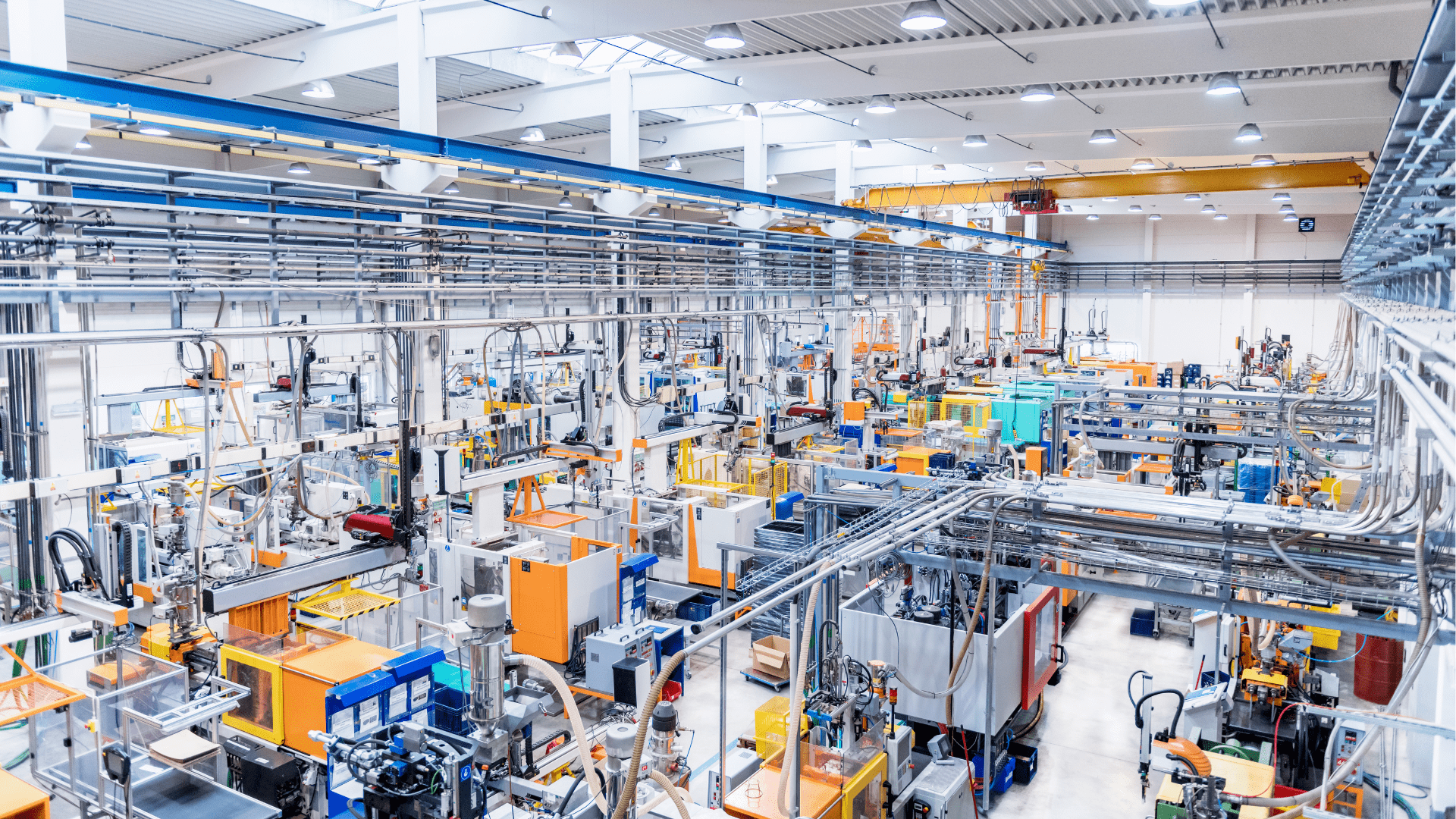

Navigating Family Business Succession: Expert Tips for Family-Run Manufacturing Businesses

Navigating Family Business Succession: Expert Tips for Family-Run Manufacturing Businesses

An interview with Amy Wirtz, Senior Consultant with The Family Business Consulting Group

July 11, 2024

Family businesses are the backbone of many industries, particularly in the manufacturing sector. However, succession planning in these businesses often presents unique challenges. Recently, Seth Getz from NuVescor sat down with Amy Wirtz, a succession planning expert, to discuss strategies for navigating these complex transitions.

Understanding the “Why” of Ownership

One of the critical aspects Amy emphasizes is understanding the “why” behind ownership for each generation. Entrepreneurs often have clear motivations like creating their own identity, seeking freedom, or building something significant within their community. However, second-generation owners often find themselves inheriting ownership, leading to different motivations and challenges.

“It’s crucial to plan for these transitions,” Amy explains. “The ‘why’ of ownership for each generation can change significantly. Entrepreneurs usually have a very defined purpose, but second-generation owners often struggle with understanding their role and motivation because they inherit the business rather than choose it.”

Amy points out that this difference in motivation necessitates thorough planning of leadership development and ownership transitions to ensure the business’s continuity and success.

Preparing for Non-Family Leadership

A significant shift in family business dynamics can be the need for non-family leadership. Amy discusses the reality that while family members can work in the company, they may not always be suited for top leadership roles due to a lack of experience or different interests.

“We discuss the business’s growth needs versus the family’s human capital,” Amy notes. “Family members might not be ready to take on CEO or CFO roles, and sometimes bringing in a non-family CEO can be the best option. This approach can involve non-family leaders buying a small equity stake, ensuring their commitment while keeping majority control within the family.”

This strategy allows for continued business growth and profitability while the family retains control and benefits from ongoing dividends, rather than opting for a one-time exit.

Maintaining Company Culture

Company culture is a crucial element in the success and valuation of a business. Maintaining this culture through leadership transitions can be challenging but is essential. Amy highlights the importance of identifying and preserving core cultural elements that define the company’s identity.

“Culture will naturally evolve with new leadership,” she explains. “However, maintaining the foundational values that make the company unique is vital. Each generation can add their spin, but the essence should remain constant. This approach ensures continuity and stability for both employees and customers.”

Amy suggests focusing on core values such as customer service excellence, community involvement, and quality standards. By doing so, businesses can ensure these values are upheld even as leadership and ownership evolve.

Successful Case Studies of Family Succession Planning: Hussey Seats and Lodge Cookware

Amy shares inspiring examples of companies that have successfully navigated these transitions. Hussey Seats, based in Boston, has maintained its core values through generations by holding family council meetings twice a year. These meetings reinforce their commitment to quality, service, and community involvement.

Similarly, Lodge Cookware, known for its cast iron products, has over 200 shareholders and keeps its family history and values alive through annual retreats at their ancestral farmhouse. These gatherings reinforce their commitment to maintaining a strong family bond and a cohesive business strategy.

Key Considerations for Entrepreneurs: Keep or Sell?

For entrepreneurs contemplating whether to sell their business or pass it on to the next generation, Amy advises asking critical questions about their legacy and the opportunities they want to foster for the next generation.

“The question to ask is whether you want to retain your dream or create opportunities for your children’s dreams,” Amy explains. “If the business is only continuing because it’s the entrepreneur’s dream, it may not be sustainable. However, if the next generation has a clear vision and passion for the business, they are more likely to succeed.”

Amy underscores the importance of involving the next generation in these decisions and understanding their interests and capabilities. This involvement ensures a smoother transition and increases the likelihood of continued success.

Strategic Planning for Established Family Management Groups

For established family management groups, Amy stresses the importance of having a well-defined strategic plan and placing qualified individuals in management roles, irrespective of family ties.

“Distinguishing between ownership and management is crucial for long-term success,” she advises. “Family members can be owners, but management roles should be based on qualifications and skills. This approach ensures that the business is run effectively and continues to grow.”

Succession planning in family businesses is a complex yet essential process. By understanding the evolving motivations behind ownership, preparing for potential non-family leadership, maintaining company culture, and asking the right questions, family businesses can navigate these transitions successfully.

For more insights and personalized advice, Amy Wirtz can be reached via email at wirtz@fbcg.com. NuVescor remains dedicated to supporting businesses through these critical transitions, ensuring their continued growth and success.

Recent Comments