GRAND RAPIDS, Mich. – October 14, 2022– NuVescor Group is pleased to announce the successful sale of Superior Manufacturing, LLC, to Purgo Holdings, LLC.

Superior Manufacturing, based in Fort Wayne, Ind., manufactures chemical-free, magnetic water conditioning systems used to reduce scale in residential, commercial and industrial applications. It operates under the name Superior Water Conditioning.

Purgo Holdings, LLC, a portfolio company of Wincove Private Holdings, LP, provides filtration and separation technologies for water, infrastructure, process filtration and separation. The acquisition of Superior is Purgo’s fourth since its formation and bolsters the platform’s water treatment product offering.

“We are excited to welcome Superior Water Conditioning to Purgo,” the Company announced. “Superior’s unique non-chemical conditioning product is a perfect add on to our LAKOS business and will allow for the expansion of our offering to existing customers and channel partners. Superior has been in the capable hands of the Sanderson family for many years. We are proud to continue their legacy of exceptional customer service and product quality in the water treatment markets.”

Scott A. Sanderson, Sr. – who with his sister, Terri Parker, co-owned the Company founded by their parents in 1964 – said the acquisition will benefit both companies.

“We have built the business over the last few years quite well and thought it was time to have some new blood to grow our father and mother’s legacy to much greater lengths,” he said. “Not only do we know some of the people who bought our company for many years, they also manufacture a product that is a good fit to be coupled with our product.

“We are excited about the future and believe the new owners will take what we have built over the last 58 years and grow it to be even more successful. They also know that the most important thing for us was to have our father and mother’s legacy continue for many years.”

Superior was assisted in the transaction by the NuVescor Group, a mergers and acquisitions company. “Working with Scott and Terri was great, and to see the legacy of their father and mother continue with a buyer like Purgo is truly something to celebrate,” said Travis Ernst, NuVescor’s operations manager. “The transaction was a win-win for Superior as well as Purgo, and we were honored to be a part of it.”

About Purgo Holdings, LLC

Purgo is a leading platform of filtration and separation technologies in high growth water, infrastructure, process filtration and separation markets. Purgo was formed in 2018 with the acquisition of LAKOS Corporation from Lindsay Corporation. LAKOS, based in Fresno, Calif., designs, manufactures and distributes branded water and liquid filtration products to the industrial, commercial, agricultural irrigation and residential groundwater markets. In 2021, Purgo acquired Steri, a Bohemia, N.Y., based designer and manufacturer of specialized filtration systems used in industrial processes primarily for the chemical and pharmaceutical end markets. In 2022, Purgo acquired ALSI, a Detroit, Mich., based manufacturer and distributor of air and liquid filtration and separation equipment used in industrial manufacturing and paint processing. For more information about Purgo, visit www.purgoholdings.com.

About Wincove Private Holdings, LP

Wincove Private Holdings is an investment company that creates long-term capital appreciation for its shareholders by partnering with business owners, entrepreneurs, and management teams to build market-leading companies. With offices in Boston and New York, Wincove has a permanent capital base, staying invested in its partner companies for an unlimited time. For more information about Wincove, visit their website www.wincove.com.

About Superior Manufacturing Corporation

Founded in 1964 in Fort Wayne, Ind., Superior was a pioneer in chemical-free water treatment technology. Founder Charles Sanderson Sr. launched the business with a vision of limiting the damage done by hard water without using hazardous chemicals. Second-generation owners Scott Sanderson and Terri Parker have increased sales by 369% since taking the company’s reins 10 years ago by keeping up with technological changes through extensive product research. Over its 58 years in business, Superior has more than 500,000 successful installations in all 50 states and worldwide and their water-treatment systems are installed in boilers, heat exchangers, cooling towers, chillers, water lines and other applications. Superior maintains a 23,000-square-foot facility in Fort Wayne.

About NuVescor Group

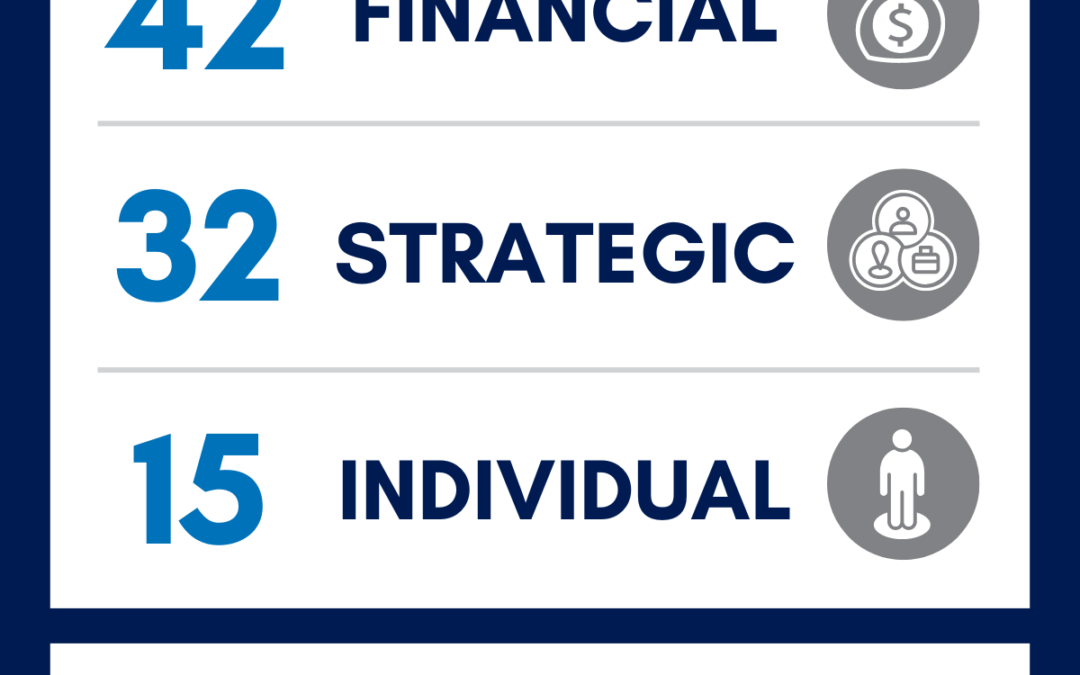

NuVescor Group, based in the Midwest, is a distinguished mergers & acquisitions service company that has served the manufacturing industry since 2007. The employees of NuVescor possess the full array of disciplines needed to complete successful and timely business transactions. NuVescor utilizes a proprietary proven process that greatly increases the success rates for business transactions as well as the customer experience. For more information about NuVescor, visit www.nuvescor.com.

Recent Comments