NuVescor By The Numbers: 2022 Closing Statistics

NUVESCOR BY THE NUMBERS: 2022 CLOSING STATISTICS

NUVESCOR BY THE NUMBERS: 2022 CLOSING STATISTICS

Detroit-Area Metal-Coating Company Sold to Investors

GRAND RAPIDS, MI – Dec. 15, 2022

NuVescor Group is pleased to announce the successful sale of a Detroit-area metal coating and cleaning services company.

The diversified metal-coating company provides innovative thin-film coating technology, service and equipment to the metal removal and metal forming industries. The Company’s technology provides improved productivity and performance in a variety of products for the medical and aerospace industries, as well as many applications involving the manufacturing of industrial components.

The two individual buyers are looking to grow and expand the business.

About NuVescor Group

NuVescor Group, based in the Midwest, is a distinguished mergers & acquisitions service company that has served the manufacturing industry since 2007. The employees of NuVescor possess the full array of disciplines needed to complete successful and timely business transactions. NuVescor utilizes a proprietary proven process that greatly increases the success rates for business transactions as well as the customer experience. For more information about NuVescor, visit www.nuvescor.com.

11 Questions to Ask When Selecting an M&A Firm

How do you know if you can trust the M&A firm you plan to hire? Have them continually give you proof and do not just take them at their word when they say “You can trust us.”

Determine the M&A Firm’s ability to prove with data they can meet your goals before committing

1. When in the process will you know if they can meet your minimum threshold of value from the type of buyer you want to sell to?

2. When will you know if the firm can create the needed buyer pool confidentially, efficiently, and in a timely manner in order to receive multiple proposals?

3. Can you easily get out of their engagement agreement if they cannot meet your goals?

Prove with a documented transparent process the M&A Firm’s ability to put in the effort required

4. Who is involved in their M&A process and do they have the skills and capacity to do what is needed?

5. How much of your time does the firm need to run their process? Will you be distracted from running the business?

6. Will the firm do the extra work to give you all the data needed to make sure you select the right buyer?

7. How will you know if the firm is doing what they told you they would do? How is each team member held accountable?

8. Can you fire them at any time if needed?

Ensure the M&A Firm’s fee structure and team member compensation align with your success

9. Is the person or persons working for you incentivized to put in the extra effort?

10. Does the compensation plan allow them to work well together as a team?

11. Does the fee the firm receives incentivize them to maximize your value?

Establishing a process to effectively compare firms is how you will find the most suitable fit and ensure the process runs as smoothly as possible. Finding an M&A firm that aligns with you and your business is what’s most important in your sale or acquisition.

The NuVescor Group is here to fully assist in handling the sale or acquisition of your business. Contact us today to learn more about how we can help!

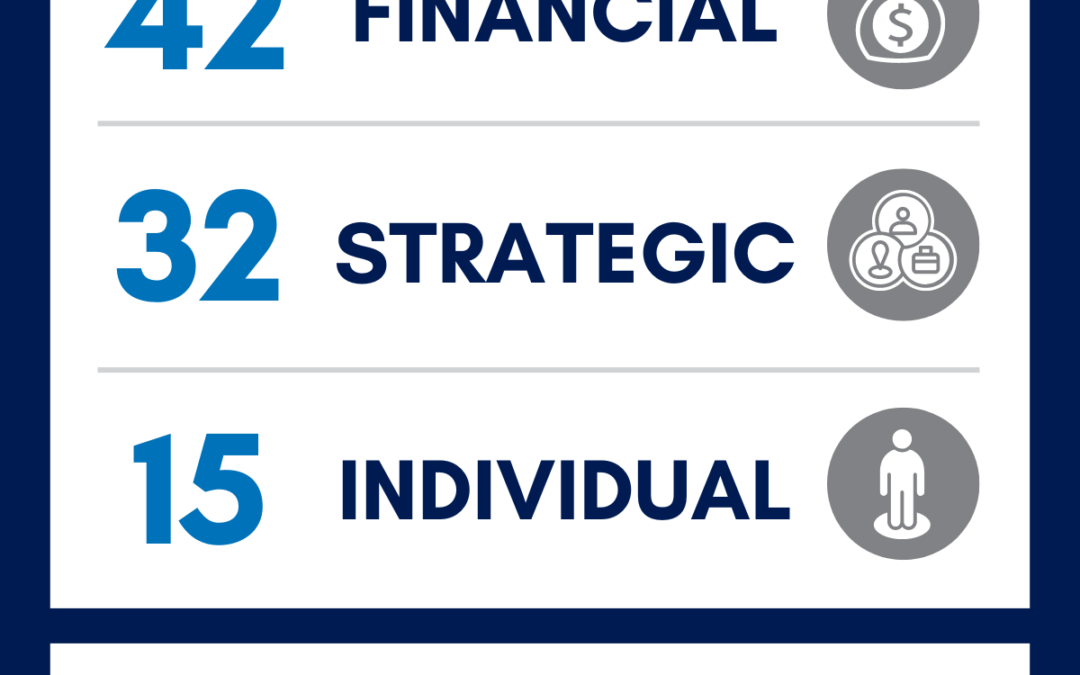

NUVESCOR BY THE NUMBERS: STATISTICS FROM A RECENT TRANSACTION

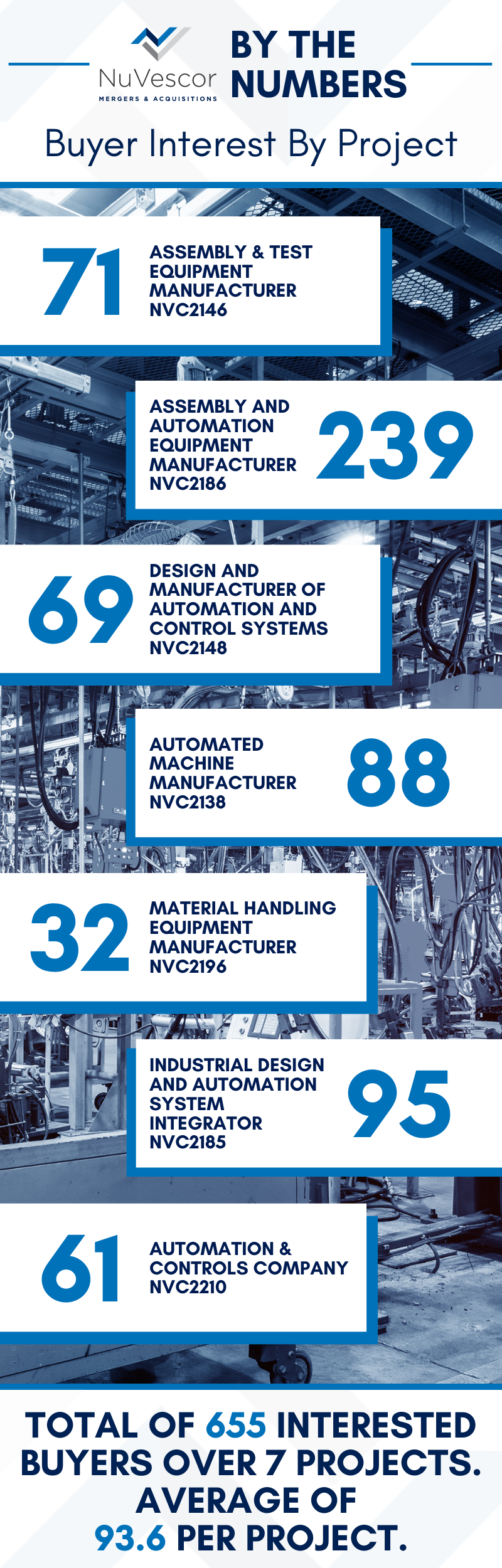

NUVESCOR BY THE NUMBERS: BUYER INTEREST BY PROJECT

Recent Comments