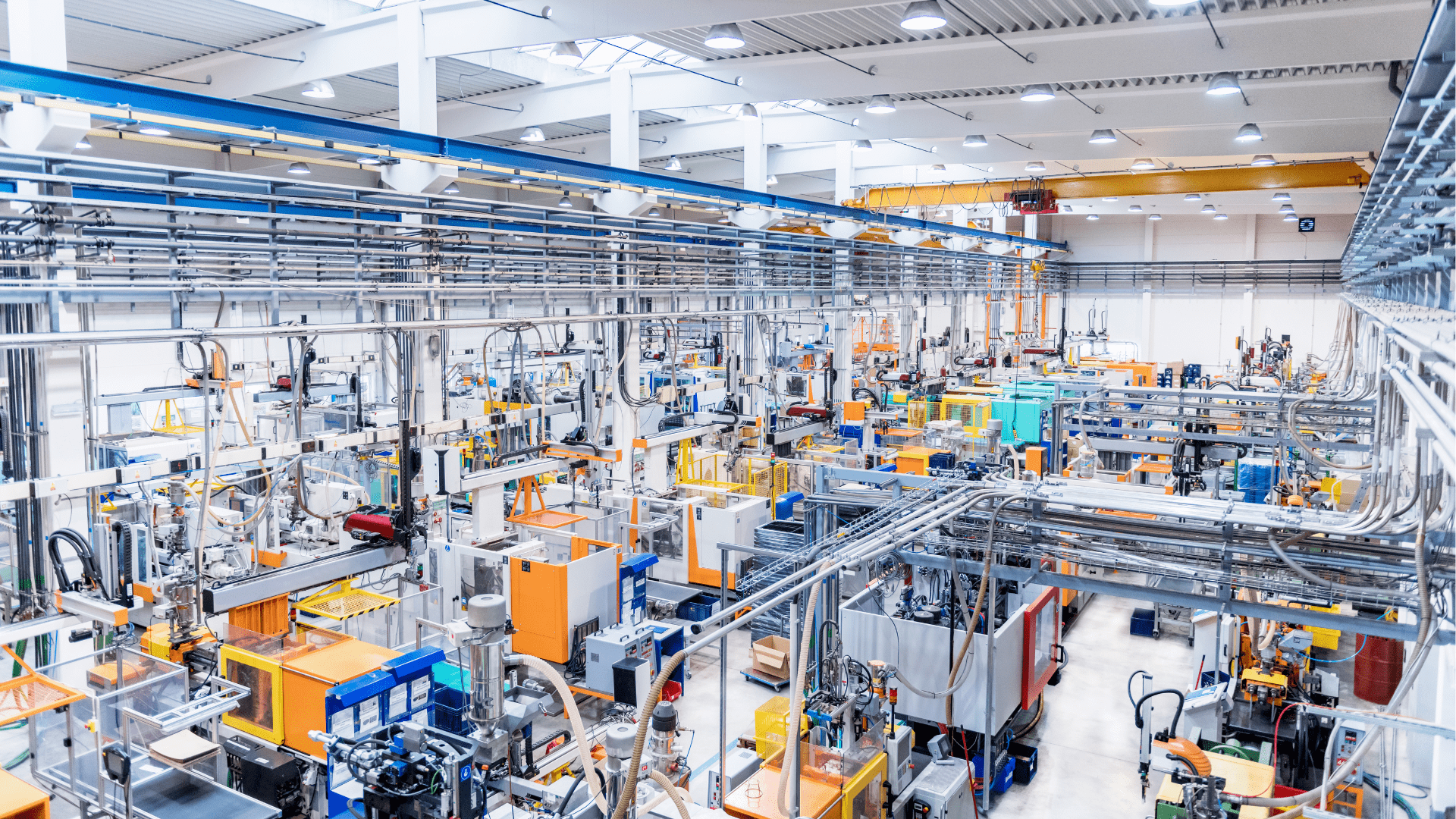

We’re currently seeing a consolidation trend in the manufacturing sector as buyers try to grow their market share and improve their bottom lines. Given this trend, now may be the right time for manufacturing business owners to think about selling their companies. However, selling a manufacturing business means finding the right buyer and maximizing the value, both of which require a good grasp of the key financial metrics that influence buyer decisions.

1. EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is typically the first metric buyers consider when evaluating a manufacturing business. By excluding the costs of depreciation and amortization, taxes, and debt payment from the company’s earnings, EBITDA is a way to show how much cash profit the firm generates. Acting as a rough proxy for cash flow, EBITDA shows buyers the cash available for them to pay themselves, buy new equipment, reinvest in the company and help generate cash that provides working capital for growth.

2. Gross Margin

Buyers use your gross margin to assess how efficiently your company produces goods. It can be hard to interpret gross margin in the manufacturing sector because of different reporting methods, so buyers will dig into the details to evaluate the costs and profitability of producing every component. A healthy gross margin is seen as a sign that your business can maintain current operations and potentially increase profitability as it scales.

3. Overhead Costs and Break-even Analysis

Buyers are also keen to understand overhead costs and your company’s break-even point—how many sales you need to make and at what margin to at least cover your costs. Considering these details helps a potential buyer understand how susceptible your business is to sales fluctuations. A comprehensive break-even analysis can help buyers assess the risk and figure out how much of a sales drop your company can withstand before it starts losing money.

4. Sales Trends and Customer Concentration

Buyers analyze historical sales data to identify patterns and potential risks. They pay particular attention to customer concentration—how much of your revenue depends on a small number of customers. If a significant portion of your sales, say 30%, comes from one or two customers, losing them could significantly impact the stability of your business. If your customer base is less concentrated, that lowers the risk, making it more appealing to buyers.

5. Revenue trends

Buyers will average revenue over time to get a picture of the health of the business, rather than just looking at a snapshot in time. The key here is that growth is good but that not all growth is equally appealing. Potential buyers are looking for steady growth of, say, 10-15% year on year over a period of time. That kind of growth is attractive because it shows consistency and indicates that the team knows how to grow the business in a sustainable way. On the other hand, rapid “hockey stick” growth can be concerning for some buyers. If they see, for instance, 30% growth, they may worry about how sustainable the growth is or even if they are buying at the peak before a potential downturn.

A downward trend in revenue is obviously more of a warning sign for potential buyers, who will want to take a closer look into the reasons behind it.

6. Debt to EBITDA Ratio

The debt to EBITDA ratio is a metric that is fundamental to how the deal will be structured. Buyers use this ratio to determine how long it might take to pay off debt and how much debt your company can support based on its earnings. A high debt-to-EBITDA ratio might indicate your business is over-leveraged, potentially reducing its attractiveness. On the other hand, a lower ratio suggests that your company is financially robust and capable of servicing its debt while still providing a good return on investment.

7. Working Capital

Working capital is typically defined as current assets minus current liabilities and represents the amount of capital that your company needs to maintain ongoing operations. If your business ties up a significant amount of capital in inventory or accounts receivable, it may raise concerns about cash flow management.

Take, for example, a proposed sale price of $4 million for a manufacturing company that procures a large quantity of raw materials from China. To optimize costs, the company purchases these materials in bulk, resulting in high inventory levels. The company serves large customers with extended payment terms, leading to substantial accounts receivable (AR). In this scenario, the business has approximately $2.5 million in receivables, $1.8 million in inventory, and minimal accounts payable, resulting in working capital of around $3.5 million. However, given relatively modest sales figures of around $5 million, buyers might be concerned about the amount of capital that is tied up in inventory and receivables relative to sales. The worry is whether the buyer will have to keep that ratio the same as sales grow, potentially impacting future liquidity.

Buyers also expect working capital to be included in the sale price of the business so the company can continue to operate smoothly post-acquisition. In this case, with the suggested $4 million purchase price, the buyer would be paying just for working capital, leaving little for goodwill or other assets. With this kind of example, it’s easy to see how managing working capital efficiently is essential to maximizing the value of your sale.

8. Profit Margins and Sustainability

Buyers typically look for profit margins in the 10-15% range because that indicates there’s a healthy balance between pricing and cost management. On the other hand, margins below 10% can raise concerns about potential issues with pricing strategy or cost control. If margins dip closer to 5%, buyers may still consider the business, but they will likely offer both a lower valuation and require a solid plan to improve margins.

Profit margins that are too high can also be concerning to buyers. For instance, margins in the 30-50% range might initially seem appealing but raise questions about sustainability. Will an attempt to scale increase infrastructure costs or drive up other expenses that erode the margins? Buyers will want to carefully evaluate whether high margins are the result of a robust business model or artificial inflation caused by unsustainable practices.

Each of these metrics conveys information about the financial health, profitability, and potential for future growth of your business. Understanding and optimizing these metrics can make your company more attractive to buyers.

Why Now Might Be the Right Time to Sell

While there is no way to predict what the future holds, Private Equity and strategic buyers are active right now, and demand is strong for quality manufacturing businesses. However, whether the time is right to sell your business depends on more than just macroeconomic conditions and buyer demand.

At NuVescor, we know that the decision to sell isn’t simply a business transaction – it’s about securing your financial future, maintaining your hard-earned reputation, and ensuring the continued growth of what you’ve built. You want a buyer who doesn’t just see the financial value of your business, but who also shares your vision, appreciates your values, and is committed to upholding your legacy.

The manufacturing M&A experts at NuVescor can help you assess whether now is a good time to sell your manufacturing business, based on your unique goals and situation. We follow a proven process designed to help you make this complex decision and move forward with confidence.

Learn more about our sell-side services.

If you’re ready to take the next step, book a meeting or contact us to discuss how we can help you maximize the value and find the right buyer.

Recent Comments