How M&A is Shaping the Plastic Parts and Injection Molding Industry

How M&A is Shaping the Plastic Parts and Injection Molding Industry

June 27, 2024

The plastic parts and injection molding industry shows a reflection of the broader manufacturing landscape. Notably, market consolidation is increasing. It’s a market where business owners have a unique opportunity to leverage these trends for strategic growth through M&A.

A Market of Contradictions

The performance of plastic part manufacturers is a tale of two cities. If you’re in the automotive field, for instance, it can be a challenging place right now. Many manufacturers had shifted their focus to parts for electric vehicles (EVs), but now they are increasingly reverting to producing parts for gas engine vehicles. Your performance very much depends on which product line you’re most invested in. Defense, on the other hand, is booming, and there’s plenty of opportunity for plastics manufacturers there.

This mixed bag creates a diverse buyer pool. Strategic players are seeking acquisitions for different reasons: expanding capacity, entering new markets, or acquiring specific capabilities like finishing expertise. For example, suppose a company has a lot of defense work but doesn’t have the right equipment or people. In that case, it’s currently easier to buy a company focused on, say, automotive, which has extra capacity than to ramp up existing resources. This kind of market landscape presents a golden opportunity for plastic parts manufacturers to align with buyers’ strategic goals.

A Surge in M&A Activity

Recent industry reports show M&A activity in the plastics industry rebounded during the second half of 2023 after a rather challenging start, and this activity seems to be continuing in 2024. Several critical factors are driving this consolidation wave:

- Economies of Scale: Larger companies can use their buying power to secure better deals on materials and equipment, driving down production costs.

- Technological Advancements: M&A is a strategic pathway to acquire expertise in cutting-edge technologies like automation, robotics, and additive manufacturing (3D printing). Instead of developing the latest automation and robotics technologies in-house, which could be time-consuming and expensive, a company can instead acquire a smaller company that already specializes in these areas.

- Market Expansion: Companies are using M&A to gain access to new markets, product lines, and customer bases, enhancing their competitive edge.

The Future of the Industry: Continued Consolidation Through M&A

The current trend towards consolidation through M&A in the plastic parts and injection molding industry will continue. Here’s why:

- Benefits of Diversification: Companies heavily reliant on a single niche or customer base are vulnerable to market fluctuations. Diversification through M&A allows companies to weather economic ups and downs.

- Rise of Regional Powerhouses: Expect the emergence of larger, regional companies with a presence across the medical, aerospace, defense, and automotive sectors. This diversification will enable them to manage risk and offer their clients a wider range of capabilities.

- The Fate of Smaller Players: Smaller, non-diversified companies may struggle to compete. However, those catering to niche markets with strong growth potential can still thrive independently.

And let’s not forget the upcoming wave of baby boomer retirements that will further drive M&A activity. Many plastics parts manufacturing businesses are owned by this generation, and the perceived volatility of the industry and economy can discourage some from passing the torch to the next generation. This creates a prime opportunity for M&A, making it a highly attractive and timely option. To stay ahead of the curve, it’s crucial to act now before others capitalize on this trend.

Beyond the Bottom Line: What Buyers Value

Turning to buyers, what are they looking for today? Beyond financial performance, there are two key factors that, in my experience, are significantly impacting a company’s value proposition in today’s market:

- Inventory Management: Gone are the days of overflowing, untracked warehouses. Buyers seek partners who demonstrate efficient inventory control and clear justifications for holding specific materials. Streamlined operations are key.

- Automation: Modernization is no longer optional. Companies lagging behind in automation will find themselves at a disadvantage. Integrating automation demonstrates a commitment to efficiency and future-proofing.

Strategic Advice for Business Owners

For business owners considering M&A, it is essential to identify your niche and focus on your strengths. Understanding your company’s unique value proposition—whether it’s expertise in automation, a strong customer base in a growing industry, or dominance in a particular niche market—is crucial for attracting the right buyer. Engaging a strong M&A advisor can help identify and connect you with strategic buyers aligned with your goals.

Conclusion

The plastic parts and injection molding industry has some unique opportunities for strategic growth, and now is the ideal time for business owners and potential buyers to leverage these trends. Companies that strategically position themselves and take a disciplined approach to preparing for M&A can enhance their value, and buyers have plenty of options for strategic acquisitions.

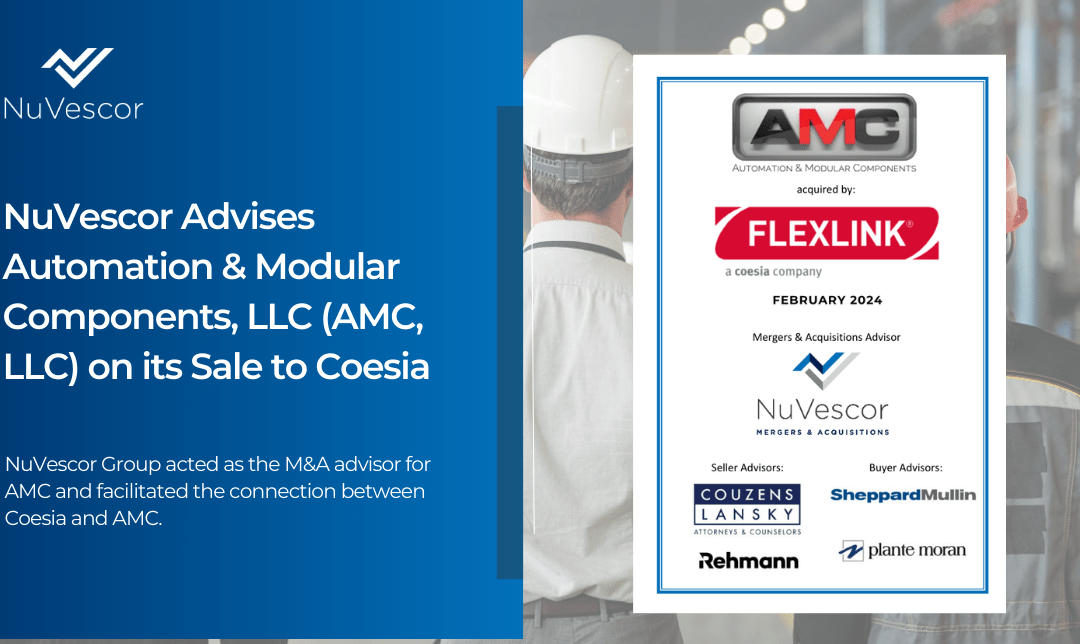

Engaging an experienced M&A advisor can help you navigate this complex landscape and connect you with strategic partners aligned with your goals. At NuVescor, we’ve had years of experience coping with market ups and downs and helping companies work through the challenges.

If you’re a mid-sized manufacturer seeking to sell your business or a buyer looking for a strategic acquisition, contact us to see how we can help you navigate the M&A process and achieve a successful outcome.

Recent Comments