Featured on Automation.com: From Shop Floor to Boardroom: How Automation is Transforming Manufacturing Deals

Featured on Automation.com: From Shop Floor to Boardroom: How Automation is Transforming Manufacturing Deals

September 9, 2024

As Featured on Automation.com: This article by Randy Rua was recently published as a featured article on Automation.com, a leading online publisher of automation-related content.

Article Summary

In today’s competitive environment, manufacturing companies are facing mounting challenges, including supply chain disruptions, rising operational costs, labor shortages, and geopolitical instability. To combat these issues, many are turning to automation technologies like robotics, AI, and machine learning. This shift is not only transforming operations but also reshaping the M&A landscape. Companies with advanced automation capabilities are becoming more valuable, attracting potential buyers and investors.

Automation is driving efficiencies in maintenance, material handling, and real-time monitoring, improving scalability and “future-proofing” businesses. In addition, M&A processes themselves are being streamlined through automation, from deal sourcing to strategy development. As automation continues to evolve, it will be a key factor in driving manufacturing M&A activity through 2025.

Read the full article here

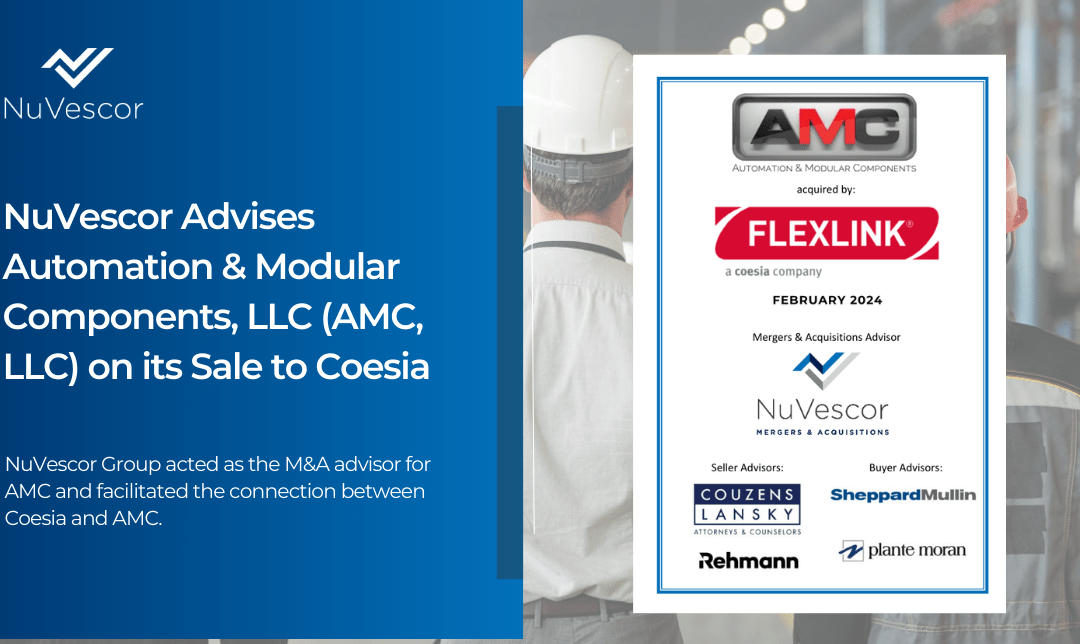

About the Author: Randy Rua is the president of NuVescor, a leading provider of mergers and acquisitions services for manufacturers in Michigan and beyond. For more information, contact Randy at rrua@nuvescor.com.

Recent Comments