Exiting Your Metal Fabrication Business: Buyer and Seller Perspectives for a Successful Transition

Exiting Your Metal Fabrication Business: Buyer and Seller Perspectives for a Successful Transition

May 20, 2024

According to Industry Select, the metal fabrication industry includes some 34,000 companies in the US. With 75% of all business owners planning to exit within the next decade (per the Exit Planning Institute), it seems likely that a good proportion of metal fabrication business owners are currently thinking about their exit strategy and how best to maximize the value of their company.

While the market is lively at the moment, a staggering 75% of transactions fail before closing. Even when the transaction is completed and the sale goes through, we have found that a large number of buyers and sellers regret the deal they’ve made. At NuVescor, our goal is to help educate and help fabricated metal business owners prepare better to avoid those outcomes. We’ve gathered perspectives from both buyers and sellers to help you think through your own exit process.

Current State of the Metal Fabrication Industry

The metal fabrication industry is in the midst of a significant shift thanks to some key drivers:

- Rise of Automation: The industry is moving away from relying purely on skilled craftspeople and embracing automation. Equipment like laser cutters, material handling systems, and automated benders and welders are increasing efficiency and reducing dependence on specific skillsets.

- Consolidation: Due to the growth of automation—and its high cost for smaller shops—the fragmented nature of the industry is changing. Larger players are acquiring smaller businesses to achieve greater economies of scale and invest in advanced automation. The current market fragmentation presents a good opportunity for potential sellers to capitalize on consolidation trends. However, as consolidation progresses, the window of opportunity might shrink.

- Exit Planning Surge: Industry surveys, as mentioned above, suggest that 75% of business owners plan to exit their businesses within the next decade. This presents a wave of potential acquisition targets for consolidators and strategic buyers. However, as the wave of consolidation continues, buyers are becoming more selective and will likely prioritize companies that are well-positioned to adapt to automation and changing market dynamics.

Preparing for a Sale

According to Eric Fogg, former owner of Holland Custom Metalworks, “… the moment you created your business, it was for sale, and that sale is inevitable, whether it’s generational or ESOP or whatever it is, the sale of it is inevitable.” Given that, it is never too early for a business owner to start planning for the sale of the business.

Planning for the eventual sale of your business means having your financial records in order, investing in the business with a view to future value, and putting in place the right management team to run the business efficiently. These are all key factors that sellers will be looking at when considering the value of your business to them. “You have a day job that’s running your business, and this is your other job, which is selling your business,” says Raji Singh, President & Founder of Broadgate Capital. “They’re both jobs, and it takes a lot of work.”

However, planning for a sale also means considering the kind of buyer you want and, most importantly, according to Fogg, thinking about what you will do after the sale. “I would highly encourage you to engage in a new purpose even before the sale starts. Practice it. Get involved. Get your passion for what you view as your next phase started before you sell,” he says.

Making the Right Match

As a seller, choosing the right buyer for your business can shape the decisions you make for years before the sale. In a recent article for MetalForming Magazine, we noted the following types of buyers:

- Strategic buyers may place a premium on a company’s technology and customer base. A strategic buyer could be another metal fabrication company looking to expand its reach or acquire new locations.

- Private Equity firms are interested in the potential for consolidation. While they might offer a higher price, it’s unlikely to be all cash, and they often require the seller to retain some ownership and stay involved for several years.

- Internal buyers. While a smooth handover to a trusted individual seems appealing, challenges often arise around financing. If the internal buyer lacks sufficient funds to cover the full purchase price and requires a significant amount of financing, it can keep the seller tied to the success of the business and hinder his ability to retire or move on.

From the seller’s perspective, a good buyer is the one that most closely matches your vision for the company’s future, has a similar or compatible company culture, and allows you to achieve your next move.

From the buyer’s perspective, an attractive company and a good seller will have organized and transparent financials, a strong management team that the buyer can rely on to provide cultural continuity, and a well-organized shop floor that is positioned for future growth.

Additionally, buyers are looking for sellers who have put the time in to prepare for a sale., according to Singh. “From a buying perspective, we’re looking for companies that have been educated on the sale process so that they’re not just kind of kicking tires to see what’s out there,” he says. “I think being prepared to go to market is very, very important.”

The Role of Professional M&A Advisors in Ensuring a Successful Exit

“The easy part is finding a buyer,” says Randy Rua. “But to know if it’s the right buyer, you have to do your preparation work.”

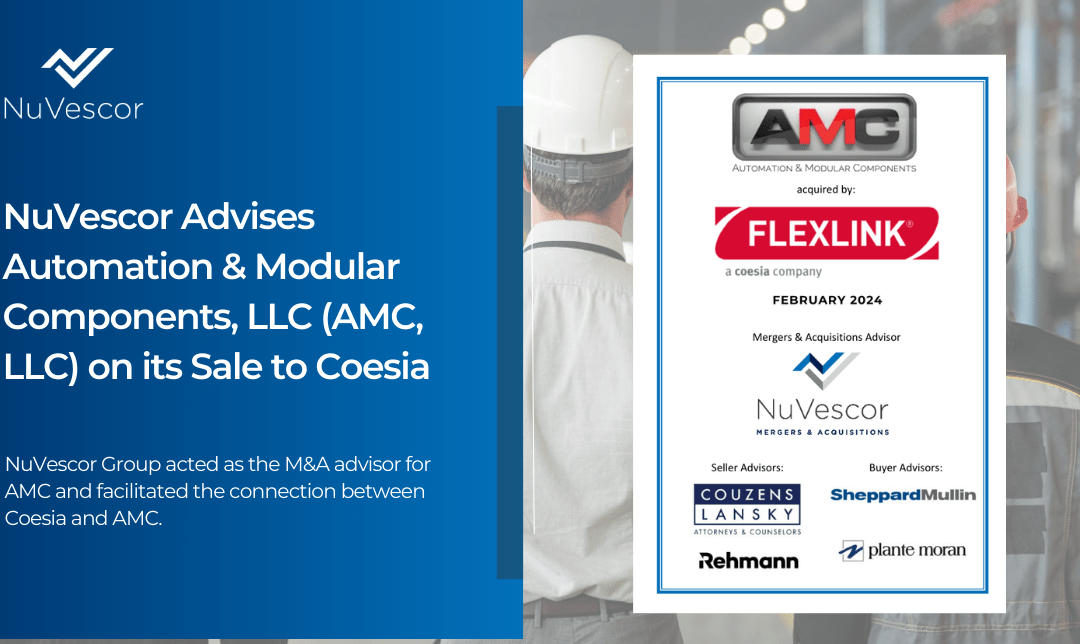

That preparation for success is really where professional M&A advisors like NuVescor shine. While a business broker will simply make the introductions, an M&A advisory firm will help both buyers and sellers carefully assess the company’s strengths, weaknesses, and objectives, laying the groundwork for a strategic approach to the sale. Industry-specific M&A firms like NuVescor often include teams of specialists in financial analysis, market research, and operations, ensuring owners have support and guidance on every angle as they go through often complex negotiations and legal considerations.

“Over the years, I’ve realized that the more detailed the LOI, the less complicated it’s going to be when you get to the document stage,” says Singh. “We spell out what kind of assets and liabilities are going to be delivered and provide details of the incurred networking capital. We include how long a seller is required to stay on board with us. It seems like it could be overkill, but from a seller’s perspective, can you imagine going through three months of due diligence and then kicking off legal documentation and finding out there are terms in there that you had no idea existed?”

One of the most sought-after services M&A advisors provide is to walk sellers through the valuation process. A common approach is to use a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) which represents the company’s operating performance and profitability. However, with metal fabrication businesses, the valuation can be much more complex as factors like the structure of the deal, the seller’s preference for cash or equity, and how long the seller wants to stick around can all significantly affect valuation.

As we’ve discussed, not every buyer is a perfect match for every business or every seller. M&A advisors can take a tailored approach, helping you develop a realistic understanding of where different potential buyers see value and how to position your business to maximize its valuation potential.

How NuVescor Can Help

The metal fabrication industry is undergoing significant transformation, and with a wave of business owners nearing retirement and automation on the rise, a well-planned exit strategy is crucial to maximizing your value. We’ve helped numerous fabricated metal businesses leverage their strengths to achieve remarkable growth and secure lucrative exits. We handle everything from valuation and buyer identification to discreet negotiations and seamless deal closure so you can focus on your well-earned retirement or next venture.

If you want to hear more, check out our webinar, Successful Exit Strategies for Fabricated Metal Business Owners, with Eric Fogg and Raji Singh.

Ready to seize the opportunities? Book a Meeting with NuVescor today.

Recent Comments