A Guide to Choosing the Right M&A Partner for Your Mid-Sized Business

A Guide to Choosing the Right M&A Partner for Your Mid-Sized Business

June 5, 2024

Understanding the M&A Advisor Landscape

Business Brokers

A business broker acts as a middleman, specifically focused on buying and selling smaller family-owned, sole proprietorship, or small partnership businesses. They handle many administrative tasks, connect buyers and sellers, and assist with deal negotiation and closing.

While cost-effective and offering a simpler transaction process, business brokers typically deal with smaller businesses, so their expertise might be too limited for highly specialized industries or complex transactions.

Investment Banks

On the other end of the spectrum lie investment banks. These powerhouses focus on large corporations with billion-dollar deals. Investment banks offer a comprehensive suite of services that extend far beyond mergers and acquisitions (M&A), encompassing a comprehensive suite of financial advisory services like capital raising, initial public offerings (IPOs), and risk management. This breadth of expertise, extensive resources, and global reach make them ideally suited for complex, high-value transactions.

Investment banks serve as strategic advisors for corporations on both ends of the spectrum – those seeking to sell (sell-side) and those eager to acquire (buy-side). Seasoned deal professionals with a detailed understanding of intricate financial mechanisms guide clients through complex transactions. For sellers, investment banks evaluate the worth of companies, pinpoint suitable buyers, create compelling marketing materials, and negotiate optimal terms. On the buy-side, these banks aid in target identification in line with strategic objectives, conduct thorough due diligence to assess risks, and structure acquisitions for maximum advantage. Their vast experience and access to global financial markets enable them to excel in high-value, intricate transactions.

However, these services come at a high cost. Investment banks typically charge significant fees, making them a less suitable option for smaller or mid-sized businesses operating in niche industries or with simpler transactions.

Industry-Specific M&A Firms

While business brokers cater to smaller businesses and investment banks dominate the large-cap world, a gap exists for mid-sized companies. Here’s where industry-specific M&A firms step in, offering a unique blend of specialized knowledge and M&A expertise.

Unlike general M&A firms, industry-specific firms focus on companies within a defined sector, like manufacturing (in the case of NuVescor) or technology. This deep understanding of the industry allows industry-specific M&A professionals to provide highly targeted services to mid-sized businesses that offer several advantages:

- Identifying ideal buyers: Industry-specific M&A firms cultivate a network of qualified buyers actively seeking acquisitions within their niche. This targeted approach ensures a seller’s business is presented to potential buyers who genuinely understand its value proposition and are a strategic fit. For buyers, it’s a more efficient way to find target companies that meet your business goals.

- Tailored value creation: Deep knowledge of industry trends and valuation metrics allows industry-specific M&A advisors to position businesses for maximum value by identifying and highlighting factors specific to your industry that enhance a company’s attractiveness to potential buyers. This also makes it easier for buyers to quickly evaluate potential target businesses.

- Navigating industry-specific issues: Industry-specific M&A firms understand the regulatory environment, competitive landscape, and operational complexities unique to your industry. This allows them to anticipate potential challenges and develop effective strategies for the M&A process.

Industry-specific M&A firms also offer a comprehensive suite of services beyond simply connecting buyers and sellers. They act as strategic partners throughout the M&A process, providing guidance in key areas, including buy-side and sell-side representation, capital raising, and strategic consulting guidance to help you achieve your long-term goals with any transaction.

While they may have less experience handling very large or intricate deals than major investment banks, a. key advantage to working with an industry-specific M&A firm is their ability to tailor their approach to maximize value within your specific sector.

Choosing the Right Advisor

So, how do you choose the right M&A advisor for your specific needs? Your first step is to consider these key factors:

- Transaction size: Business brokers are well-suited for smaller deals, while investment banks handle large, complex transactions. For mid-market deals, industry-specific M&A firms offer a tailored approach.

- Industry expertise: If specialized knowledge is crucial, an industry-specific M&A firm can leverage its in-depth understanding of your sector.

- Complexity: Investment banks might be the best choice for intricate, multi-layered transactions.

- Cost: Business brokers generally have lower fees, while investment banks typically have the highest.

Ultimately, there’s no single perfect answer. Understanding the strengths and limitations of each advisor type empowers you to make an informed decision. The right advisor can ensure a smooth, successful M&A process that maximizes value and helps you achieve your goals.

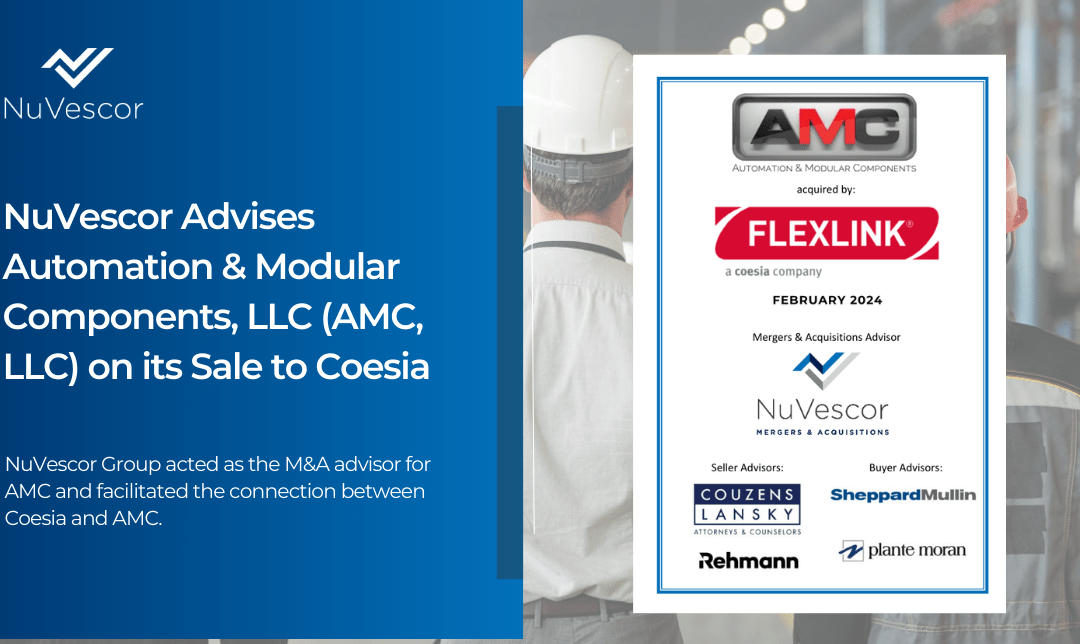

NuVescor’s Niche: Industry-Specific Expertise for Mid-Market Success

NuVescor caters to the specific needs of small to mid-sized businesses in the manufacturing sector, with a revenue range of $5 million to $500 million. We offer a personalized approach that prioritizes strategic fit and value creation by focusing on:

- Deeper market knowledge: Our team possesses a comprehensive understanding of the current trends, challenges, and opportunities specific to the manufacturing industry. This allows us to effectively value your business, identify qualified buyers, and negotiate strong deals within the manufacturing landscape.

- Vetted buyer network: NuVescor has cultivated a network of pre-qualified buyers actively seeking acquisitions in the manufacturing space. This targeted approach ensures sellers are introduced to serious contenders who understand your industry’s value proposition, and buyers don’t waste time on companies that don’t fit their needs.

- Collaborative approach: We believe in a transparent and collaborative partnership. Our team acts as an extension of yours, guiding you through each step of the M&A process with clear communication and a commitment to achieving your goals.

- Strategic deal structuring: NuVescor goes beyond simply matching buyers and sellers. They work with you to structure the deal to optimize your outcome.

- Focus on value creation: NuVescor doesn’t just sell businesses; we help sellers prepare their businesses and create value for a successful transition.

The decision of who to partner with for your M&A transaction is crucial. NuVescor offers a compelling alternative to traditional business brokers and investment bankers, providing industry-specific expertise, a collaborative approach, and a tailored approach to deals for mid-sized manufacturing businesses.

Considering NuVescor?

If you’re a mid-sized manufacturer seeking to sell your business or a buyer looking for a strategic acquisition, contact us to see how we can help you navigate the M&A process and achieve a successful outcome. Book a Meeting with NuVescor today.

Recent Comments